fsa health care meaning

You will not be able to incur new expenses during this period unless you are eligible for and elect COBRA. FSAs and HSAs are pre-tax accounts you can use to pay for healthcare related expenses.

Health Savings Vs Flexible Spending Accounts

Health Care FSA means the health flexible spending arrangement which consists of two options.

/what-is-a-qualifying-event-for-health-insurance-4174114_4-54f1444bbef84c2aa79485ceffd1cee7.png)

. A flexible spending account FSA is a type of savings account usually for healthcare expenses that sets aside funds for later use. A flexible spending account FSA is a type of savings account usually for healthcare expenses that sets aside funds for later use. An FSA or flexible spending account is an employer-sponsored healthcare benefit that allows employees to set aside up to 2850 2022 annually to cover the cost of qualified medical.

A medical flexible spending account FSA is a tax-advantaged account maintained by employers where employees can set aside a portion of each paycheck to pay for out-of-pocket medical. You decide how much to put in an FSA up to a limit set by your employer. Luckily a little bit of relief can be found in the form of a Healthcare Flexible Spending Account or HCFSA.

Get the top FSA abbreviation related to Healthcare. Allowed expenses include insurance copayments and deductibles qualified prescription drugs insulin and medical devices. To qualify for an HSA you must have a high deductible health plan.

The General-Purpose Health Care Flexible Spending Arrangement GPFSA or the Limited. Healthcare FSA abbreviation meaning defined here. If you have a Health FSA also.

A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. 8 You can use the funds in your FSA to pay for. A health care FSA can be used for medical expenses over-the-counter items dental care and vision care while a dependent care FSA can be used for services like preschool summer day.

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. What does FSA stand for in Healthcare. A healthcare flexible spending account FSA is an employer-owned employee-funded savings account that employees can use to pay for eligible healthcare expenses.

Fertility Society of Australia. FSA stands for flexible spending account. What is a Flexible spending account FSA.

Also called a medical FSA you use it to pay for qualified medical pharmacy dental and vision expenses as defined in Publication 502 from the IRS. A flexible spending account is a tax-free fund that employees not self-employed individuals can use to pay for qualified out-of-pocket. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

An FSA or Flexible Spending Account is a tax-advantaged financial account that can be set up through an employers cafeteria plan of benefits. The money used to fund your dependent care FSA is pretaxmeaning it is taken from your paycheck before taxes are deducted. COBRA or the Consolidated Omnibus Budget Reconciliation Act lets you continue.

Parents and guardians can save a significant amount of. Health care flexible spending account refers to a type of savings account which allows employees to set aside a portion of their pre-tax earnings to pay for out-of-pocket medical expenses such. With both FSAs and HSAs you.

An FSA is a financial account that employees can fund with pretax contributions. Healthcare FSAs are a type of spending account offered by.

/what-is-a-qualifying-event-for-health-insurance-4174114_4-54f1444bbef84c2aa79485ceffd1cee7.png)

What Is A Qualifying Life Event

Insurance Abbreviations And Acronyms Made Easy

Msas Hsas And Fsas Comparing The Differences Smith Anglin

What Is An Fsa Definition Eligible Expenses More

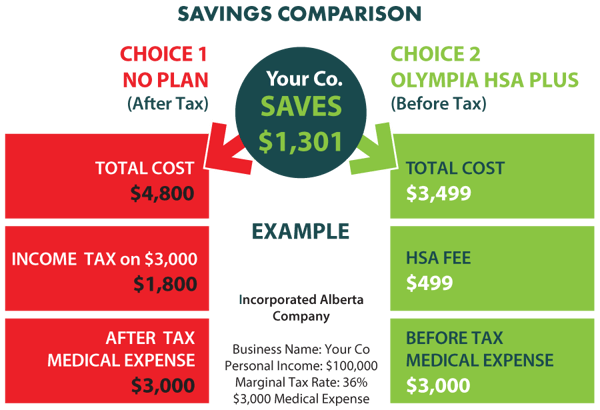

How Does A Health Spending Account Work For Small Business In Canada

Hsa Vs Fsa Vs Wsa Which Is Best For Your Employees Collage Magazine

How To Use Your Fsa For Skincare California Skin Institute

Free Health Information Technology Lesson Plans Information Technology Health Information Management Health Information Systems

![]()

Fsa Use It Or Lose It Rule Goes Away

Flexible Spending Accounts Or Fsas What To Know Before You Opt In Contribute Or Spend Real Simple

How Does A Health Spending Account Work For Small Business In Canada

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

What Do I Need To Know About Fsas And Hsas One Medical

/GettyImages-629388550-e4fd4d3f5b094ad099fb0d68e42e2d4c.jpg)

Does Money In A Flexible Spending Account Fsa Roll Over

What Is An Fsa Definition Eligible Expenses More

How To Save With Fsa Hsa Eligible Cpap Supplies Cpap Cpap Machine Supplies

Making Sense Of Spending Accounts Collective Health

This Glossary Explains What The Words And Phrases Mean For Health Insurance And Medical Term Medical Terms Medical Billing And Coding Medical School Essentials